Ola Electric has made history in the Indian automobile industry by bringing attention to itself with a ground-breaking move: the company filed its draft red herring prospectus (DRHP) for an IPO. In order to fund revolutionary projects in the field of electric mobility, Bhavish Aggarwal launched the massive electric vehicle company with a goal of raising an incredible Rs 5,500 crore. Now let’s explore the specifics of this noteworthy move.

Ola Electric’s IPO Ascent

Ola Electric’s initial public offering (IPO) will use a dual offering method, with a new share issue and a selling offer. With a valuation of Rs 5,500 crore, the new issue component seeks to further Ola Electric’s expansion in several key areas, including as debt repayment, capital expenditure on the Gigafactory project, and the construction of a cell factory. 9.52 crore shares are up for sale, with Bhavish Aggarwal spearheading the effort to sell as much as 4.73 crore of them. Other significant investors, including SoftBank and Tiger Global, have also joined in.

An Innovative Step: First IPO by an Auto Company in Two Decades

Nothing less than historic is Ola Electric’s IPO filing. This is the first IPO by an auto firm in the past 20 years, and it puts the company as the first electric vehicle (EV) company to go public in India. This change represents a significant change in the dynamics of the Indian electric car market and highlights Ola Electric’s remarkable journey from a private to a public firm.

Focus on Finances “Gains and Losses”

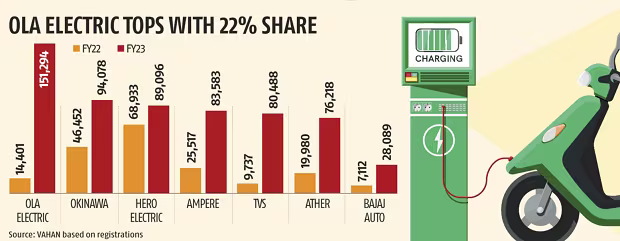

According to Ola Electric’s financial statements, revenue increased significantly in FY23—nearly seven times—to Rs 2,630.9 crore from Rs 373.4 crore the previous fiscal year. But along with this expansion, there was a loss in FY23 of Rs 1,472 crore as opposed to Rs 784.1 crore in FY22. With a 35% market share as of November, the business continues to lead the battery-powered scooter industry despite its difficulties with profitability.

Allotted IPO Proceeds: Investing for the Future:

The capital expenditure on the cell factory, the Gigafactory project, debt repayment, investment in R&D and product development, and other growth endeavours are among the strategic uses of the revenues from the IPO. The pre-IPO placement option for up to Rs 1,100 crore is also included in the draft red herring prospectus, which would help Ola Electric in its pursuit of sustainable mobility.

Ola’s Electric Scooter Success: A Major First for the Market

In the battery-powered scooter market, Ola Electric has become the market leader, holding a commanding 35% of the market as of November. With its highest-ever monthly sales of approximately 30,000 units in that month, the company reached a significant milestone. Challenges do, however, lie ahead as Ola Electric modifies its sales targets for 2023–2025 in light of the fact that fewer government incentives would affect the cost of e-scooters.

Developing India’s Electric Revolution

In addition to signifying the dynamic changes in the Indian automobile industry, Ola Electric’s daring move towards an IPO solidifies the company’s critical role in determining the direction of mobility in India. The company’s dedication to advancing environmentally friendly transport and helping India’s electric revolution is demonstrated by the IPO.

Conclusion

The entry of Ola Electric into the public offering (IPO) market is a significant turning point in the development of electric vehicles in India and the company’s transition from a private to a public actor. Founder Bhavish Aggarwal personally contributed to the historic event, demonstrating strong confidence in Ola Electric’s potential through the dual-offering plan that includes both a new share issue and stake sale.

The dynamics of the EV market are reflected in Ola Electric’s financial path. The smart allocation of IPO proceeds towards research and development, battery manufacturing, and debt management demonstrates a comprehensive approach to sustainable mobility. Beyond just raising money, the IPO represents a dedication to redesigning India’s highways for a future that is both ecologically friendly and electrically inventive.

Disclaimer: The information presented in this article is based on available sources and may not be 100% accurate.